The evolution of marine lubrication

Stuart Fuller, Market Liaison & Product Manager for Engine Oils in the Marine & Power division of TotalEnergies, recently spoke at the Nor-Shipping conference, providing insights and thoughts on the key drivers shaping the evolution of marine lubrication.

The shipping industry faces a dual challenge – more energy, with fewer emissions. It is a key target that we are working on tirelessly at TotalEnergies, with our customers, stakeholders and our partners.

How we are supporting the shipping industry’s decarbonisation journey?

Tackling our responsibilities head on, TotalEnergies has joined forces with the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping as a strategic partner, working with other industry partners to examine innovative technologies and what’s needed to build the infrastructure to support those technologies. We have so far committed three full-time colleagues that are seconded to the project, as well as enlisting the support of a further 12 colleagues on a part-time basis.

TotalEnergies also actively participates in many other industry organisations working to improve combating climate change, such as the IMO, ISO, SEA/LNG, SGMF, Ammonia Energy Association, CIMAC and more, all with a shared goal of moving shipping into a carbon-free transport.

The market drivers – life after IMO 2020

Post IMO 2020, a number of drivers have been shaping the industry, namely:

- Technology – new engine design (increased temperatures/pressures), exhaust gas after treatment, scrubbers, EGR/SCR

- Regulatory – SOx, NOx, ECAs, CO2…

- Fuels – high/low sulfur fuels, LNG, biofuels

Future fuels – navigating complexity

Currently the shipping industry is firmly focused on the directions that the future fuels market is likely to take.

Decarbonisation of transport will rely on massive investment in sustainable liquid fuels along with biofuels, supplemented by e-fuels after 2030.

The predicted take-up of H2-based e-fuels (including e-methanol and e-ammonia) is expected to take place between 2030 and 2050, and will be significant.

It is also anticipated that LNG will remain in the mix but not significantly above the post-2030 volumes.

So, we are undoubtedly heading towards a more complex market with multiple fuel solutions making up the landscape.

And with 2050 just one ship life away, shipowners and operators are going to have to make strategic fuel choices which will impact the key components of the shipping industry, including engine manufacture, fuel supply, bunkering operations, global port developments and of course lubrication development.

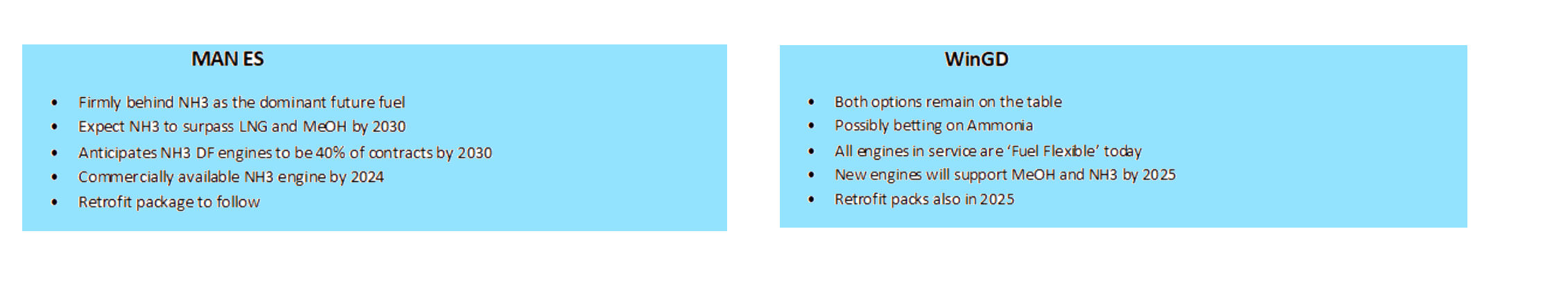

Predicting the future – the OEM view

A significant portion of the new engine orderbook today is occupied with engines able to operate on a dual fuel basis, notably LNG and/or methanol. But what does the future look like from an OEM perspective?

What is clear is that it seems there is no one size fits all solution today.

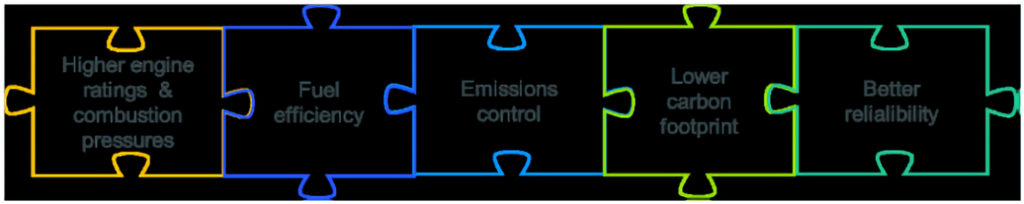

Challenges of product development – completing the formulation puzzle

From a lubrication perspective, the multiple fuels landscape presents challenges that, as manufacturers, we have to address. Different fuels will potentially have different performance requirements, and collaboration across the industry – for example with engine OEMs – is vital.

When it comes to lubrication development the formulation puzzle includes key issues such as:

Finished product stability | Compatibility | Oxidation stability |

Hydrolysis | Detergency | Dispersancy |

Thermal stability | Corrosion | Wear protection |

When formulating a lubricant, it is not as simple as selecting ‘ingredients’ and assuming they will work well when they are mixed.

We can have particularly good components for each specific purpose, but they don’t always complement each other, meaning the researchers must reach a finely-tuned balance of performance, stability, compatibility, and of course cost.

We also need time, and of course access to suitable engines, to study the effects of the proposed fuels on the lubricant.

TotalEnergies has invested heavily in ammonia testing facilities which includes the conversion of some commercially available engines to run on NH3 so that we can begin to examine the effects.

New engine designs and cylinder oil specifications

Demands placed on cylinder lubricants by modern fuels and highly-tuned engines mean that we must pay special attention to the key areas of the combustion chamber, the ring pack, the exhaust valve and especially the piston top land and top ring area.

For this we are focusing on low ash – for deposit control, and high detergency – for cleanliness.

We also need to look at key operational drivers including:

Importance of ring groove cleanliness

The importance of good piston ring cleanliness cannot be overstated. This has been seen with the more recent Category II or HD – High Detergency – cylinder oils recently introduced to the market.

So, our goal is to achieve:

whilst avoiding detergency problems which, if they occur, can result in….

If we start to get a build-up of deposits behind the rings, in the grooves, this restricts the movement of the ring in the piston groove and that affects its ability to properly seal, leading to blow-by, putting excess stresses on the ring pack which may lead to failure, excessive wear and scuffing.

New product development cycle

When we look at a typical lubricant product development cycle, we can begin to understand the complexities and time needed to deliver a viable, approved, product to the market.

First, we must identify the market needs, which takes into consideration any technical, environmental and regulatory requirements, as well as any specific requirements requested by the OEMs.

From this we can begin to draw up a view of the desired specifications.

Next, we rely heavily on the expertise and knowledge we have in our research centres to formulate candidates using components that can be known, or they can be new molecules, which are screened and modelled before selected candidates proceed to the engine bench.

Following the performance testing and analysis of the bench test results, final candidates are ranked and discussed to select a candidate to move forward for field testing.

For a cylinder oil, the testing will range from 2,000hrs for a first stage test through to 4,000hrs, or more for a full Non-Objection application to an OEM. This will often involve running the reference and candidate lubricants on a split engine. It requires at least two units to be overhauled and new parts fitted that are measured and recorded by the engine OEM. There are then intermediate inspections, generally non-invasive via the scavenge ports, before the final inspection where the candidate and reference units are dismantled, inspected and measured.

The process for a trunk piston engine would typically be 6,000hrs or more, and again two cylinders are normally overhauled at the start and end of the test, as well as interim borescope inspections. Assuming everything goes to plan we would hope to have a letter of non-objection, or approval, issued by the OEM.

It’s at this point that the decision is made whether to commercialise the product, or not. Not every product that reaches approval status is commercialised.

But the story doesn’t end there – in fact it’s just the beginning. From the time the first deliveries are made we start a process of monitoring the lubricant performance in a much wider set of circumstances than we could see with a field test. This data collection not only allows us to monitor the performance, but also to support our future R&D work.

Separating BN from cleanliness

Here we are looking specifically at two-stroke crosshead engine cylinder oils.

When we consider the so-called classically formulated products in the market, we are looking at BN 40, BN 70, BN 100 and BN 140 products.

They deliver an Ash Content Equivalent in addition to a Cleanliness Equivalent, of the typical BN value.

Until recently the market correlated Base Number, or BN, with cleanliness. Typically, the higher the Base Number, the higher the content of calcium carbonate and hence the greater cleanliness performance. It is sometimes referred to as the basicity of the product.

Generally, these products are formulated using the basic detergents of calcium sulfonate and calcium phenate. We refer to this as Conventional BN Chemistry.

When products are formulated with calcium carbonate, which is used to neutralise sulfuric acids formed during combustion, there is a balance to be found. Too much alkalinity and we can find deposits forming around the piston crown and rings which can be hard, lead to liner scuffing and piston rings sticking. Too little alkalinity and we risk having insufficient neutralisation causing corrosion of the liner.

This calcium brings with it ash. As we begin to explore lubricants for future fuels it’s clear that we must reduce the BN and the ash content, and this therefore means less calcium. But if we have said that we need the basicity (the calcium) to keep the engine clean, we face a challenge in reducing or removing it.

As far back as its launch in 2007, an early innovation of Lubmarine was Talusia Universal, with a BN of 57 and a cleanliness equivalent of BN 70.

This product ripped up the rule book and gave operators the ability to use a BN 57 in place of switching with a BN 40 and BN 70 depending on the fuel they used, in and out of ECA etc.

It was one of the first oils to be dual-fuel, validated by WinGD, and as demand for oils to fill the void of category II BN 40 increased, it has performed with excellent results as an interim solution, again to avoid switching oils.

This oil gives us a reduction in ash content.

More recently, MAN has asked lubricant manufacturers to come up with products that would have the cleanliness performance of a BN 100. These products are referred to by MAN as Category II cylinder lubricants. The demand also extended to having a product with the BN and ash equivalent of a BN 40 product.

Here we have our Talusia HD 40. With these products it seems we have reached the limits of conventional chemistry, and there is now a need to do something different.

New lubrication development – the fuel economy innovation

To highlight the processes faced by lubricant manufacturers in developing new products, our latest solution – Aurelia FE – has been developed to provide four-stroke engines with a significant decrease in fuel consumption, thus delivering reductions in operating costs and CO2 emissions.

More recently the focus has shifted slightly from just looking at outright fuel economy, to the potential to deliver real-life CO2 and emissions reduction, through fuel economy.

This becomes especially important with the recent introduction of the Carbon Intensity Index (CII) where an operator could offset some of their carbon liability by simply switching to a fuel economy lubricant.

Aurelia FE BN20, BN30 and BN40 are multi-grade type lube oils designed with advanced chemical and physical properties for achieving fuel economy on engines running on MGO (BN20), VLSFO (BN30) or HSFO (BN40).

A successful test conducted on a passenger vessel has demonstrated an independently verified average fuel economy of 4.7% on main engines with good performance and reliability.

Whilst Aurelia FE is not yet approved by engine OEMs and is not yet fully commercialised, we have been supplying the product to a RoPax operator as they found real benefit in the fuel economy performance.

Today we continue to innovate the Aurelia Fuel Economy concept, and it is currently under test on board a large cruise vessel.

Bench tests will shortly begin on the next generation of fuel economy lubricant.

Watch this space!

More specialist solutions

As we have discussed, the lubrication market is going to be an increasingly challenging one with multiple drivers shaping shipping operators’ needs. Lubricant manufacturers will have to rise to these challenges through collaboration, expertise, research, development and investment to create specialist solutions to support shipping’s journey to decarbonisation.