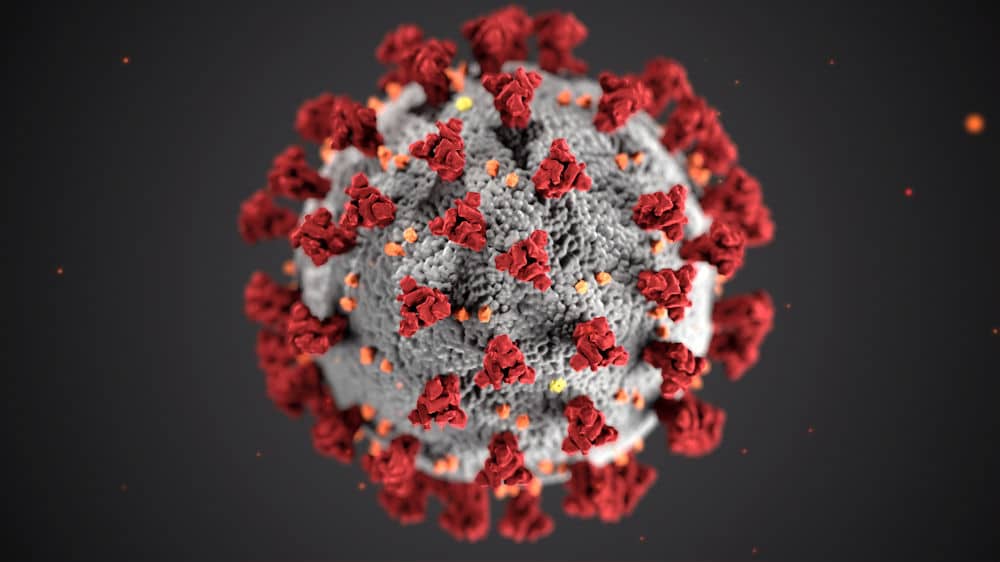

As the world waits with bated breath to find out just how bad the impact of the virus is likely to be on the ship repair industry, we take a look at some scenarios that have been put forward by BIMCO, and get some advice on contractual law from Haynes and Boone.

The outbreak of the novel coronavirus, recently dubbed COVID-19, continues to generate massive economic and financial uncertainty when it comes to China and global shipping, explains Peter Sand, BIMCO Chief Shipping Analyst.

It was only a month or so ago that BIMCO argued that – from an economic perspective – when China sneezes, we all catch the flu. Since the SARS outbreak in 2003, the global economy has become much more interlinked with China, and the Chinese economy has grown to become the second largest in the world. While hard facts and reliable data are in high demand, they are in short supply. Nevertheless it’s time for a more thorough diagnosis on how this affects the global shipping industry.

The coronavirus outbreak coincided with the Lunar New Year, which led to nation-wide extensions of the holiday. However, even with the passing of the holiday extensions, large parts of China remain closed. For every week that large parts of China are impacted by the outbreak, it becomes more difficult to reach the annual GDP growth target of 6%. At the very least, the first quarter of 2020 will mark a significant economic contraction compared to the last. As China gradually recovers, economic growth will get back to normal and shipping demand will start to lift freight rates out of the current doldrums.

Limiting the virus’ spread and ensuring economic growth is a balancing act that seems difficult to pull off, but the Chinese government remain steadfast in the quest to ensure economic growth in line with the stated target. To dampen the economic impact, the People’s Bank of China has recently implemented fiscal stimulus through interest rate cuts and reverse repo operations to maintain adequate liquidity in the banking system.

The virus itself and economic slowdown has been centred in China so far, but global supply chains have started to feel the ramifications of the widespread Chinese shutdown. Nations heavily reliant on trade with China, such as Singapore and Japan, have issued recession warnings and the coronavirus could also have a macroeconomic impact on advanced economies in the west.

Really bad ‘timing’

The outbreak comes at one of the worst times for the shipping industry, which is currently struggling with the additional fuel costs from IMO 2020 and the switch to low-sulphur fuels. One can only dread what the implications for companies might be if the coronavirus spreads at a pace greater than what is assumed in the following scenarios:

• In BIMCO’s Scenario 1, it is assumed that the virus in large parts will be contained by the end of February and that the Chinese workers will return to work during early March, prompting a subsequent pick-up in manufacturing, industrial production and refinery throughput, as well as shipping demand.

• In Scenario 2, we assume that in the medium-term large-scale quarantines will continue until mid-March, but hereafter economic activity picks up and reaches a state of normalisation by April-May.

• Scenario 3 is our worst-case scenario, where the spread continues until an indeterminate point in time. However, with the massive uncertainties related to this scenario, it remains outside the scope of this analysis to make long-term projections. It will instead primarily focus on the short to medium-term implications.

Additionally, shipyards in China, many of which would otherwise be busy with IMO 2020 scrubber retrofitting, have remained closed and declared force majeure in many cases. An estimated 150 vessels are currently under retrofit at Chinese yards (source: Clarksons). The lockdown of newbuilding yards may prove to be the only silver lining to the outbreak, as the inflow of more ships is being temporarily stopped.

Sound legal advice for ship repairs yards

By Mark Johnson, Partner, Haynes and Boone

Mark Johnson

There has been extensive reporting of the Coronavirus disease (Covid-19) impacting the international shipping industry. Reports have included quarantining ships, container ships departing ports with dramatically reduced utilisation of their TEU capacity and shipping lines facing refinancing difficulties due to market uncertainty impacting their bond values.

Repair and refit shipyards are also being impacted. In the People’s Republic of China shipyards are at a virtual standstill whilst in other countries there are reports of repair and refit shipyards receiving increased business as owners look to satisfy continuing vessel maintenance and upgrade programmes in locations that are yet to suffer significant disruption. At the time of writing, the global spread of Covid-19 shows no sign of slowing. Many shipyards are actively considering how Covid-19 could impact their contracts. This article examines, in general terms, some key English law contractual considerations, but it is always important to consider each contract and situation on a case by case basis.

Force Majeure

Force majeure clauses provide an important protection for shipyards. Unlike many civil law systems, English law does not define force majeure, or impose it automatically on commercial contracts. To claim force majeure under an English law contract, the right to do so must be set out in the contract, and force majeure will mean whatever it is defined as in the contract (see for example clause 11 (Disruption) of the BIMCO REPAIRCON). The purpose of a force majeure clause is generally to excuse a party from its obligation to perform the contract upon the occurrence specified events.

Under the usual provisions contained in repair and refit contacts, if an event occurs which comes within the contract definition of force majeure, the shipyard is entitled to an extension of time to the contractual re-delivery date. Force majeure clauses require careful review as even if the Covid-19 outbreak may come under the definition of force majeure (at least if the shipyard is closed), the consequences of the disease may extend long after the shipyard re-opens because of the impact on labour, sub-contractors, suppliers and the availability of material. Whether these further delays come within the force majeure definition will depend upon the contractual wording.

Repair and refit contract force majeure clauses are usually exclusively for the benefit of the shipyard. Shipyards should examine critically any proposal by an owner that the Covid-19 situation is such that the force majeure clause should be amended to also benefit the owners (e.g. to postpone the delivery date or delay the obligation to accept re-delivery or to cap the aggregate number of days a shipyard can claim for force majeure).

Owners’ obligations and rights

The delivery of the vessel to a shipyard in a prescribed condition by the contractual delivery date is a critical obligation of the owner. Care is required if an owner looks for a contractual right to extend the delivery window on account of Covid-19 impacting the owner’s ability to deliver the vessel to the shipyard on the delivery date. Shipyards should also carefully review how their contracts (including termination and liability arrangements) would operate if the impact of Covid-19 was to prevent a shipyard accepting delivery of a vessel on the delivery date (including whether the force majeure clause is worded so as to cover such a pre-delivery event).

As countries adapt their responses to Covid-19, shipyards may find additional obligations imposed upon them (for example in relation to decontamination of material removed from a vessel or limiting movement of personnel). Shipyards should consider the extent to which their contracts provide for such additional obligations (or at least the cost thereof) to be passed through to owners (e.g. extent to which the shipyard can amend the required delivery condition to require decontamination pre-delivery).

Contractual arrangements for redelivery and removal of a vessel from the shipyard are also matters shipyards will need to consider. We have already confronted an example of Covid-19 impacting an owner’s ability to crew a vessel, so as to be able to remove the vessel from a shipyard on completion of works.

Sub-contracting

To afford the shipyard the maximum flexibility to perform its contractual obligations, shipyards should carefully review any provision that restricts their ability to use or select sub-contractors, and, if limitation to a particular sub-contractor/maker is unavoidable in a contract, the prudent shipyard should look to include a mechanism for selecting an alternative sub-contractor/maker in the event the designated sub-contractor/maker cannot (for reasons outside the shipyard’s control) be used. Whilst sub-contractor/maker unavailability may, in part, be addressed by the force majeure clause, the ability of the shipyard to substitute a sub-contractor/maker affords the shipyard the ability to perform the works under its contracts, and therefore be due payment in a timely fashion.

This article was published in the latest issue of DryDock magazine. The full article, and rest of the issue can be found here:- https://flickread.com/edition/html/free/5e74ac2e29212#1