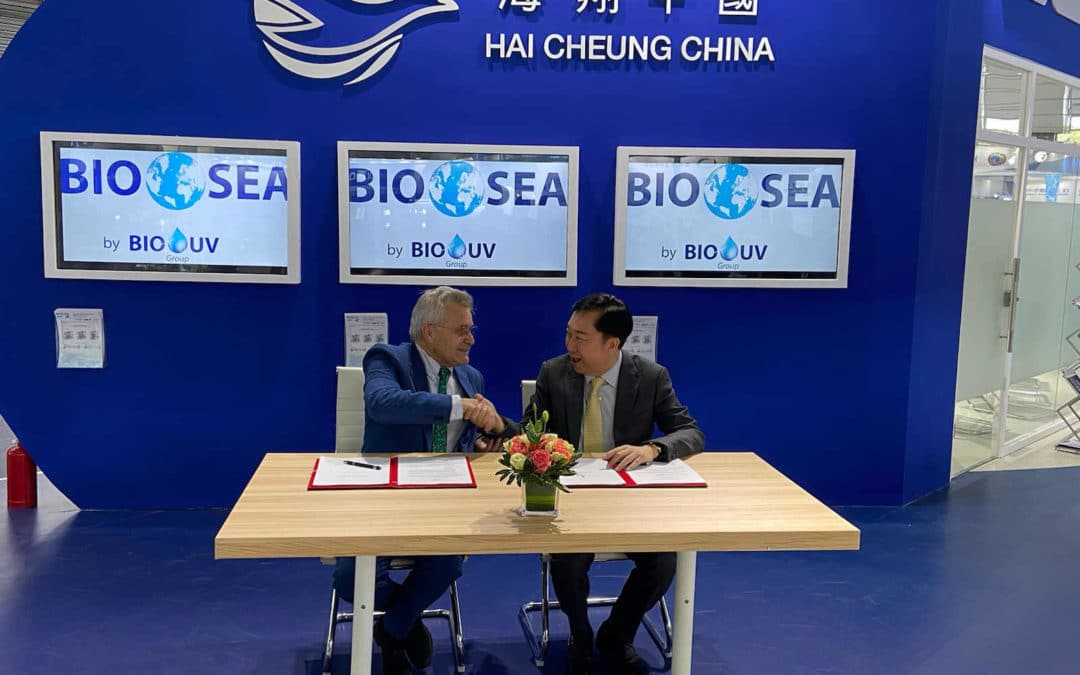

BIO-UV Group has recently strengthened its global partnership network with Hai Cheung Trading (HCT), a specialist marine equipment supplier based in Hong Kong. The strategic alliance aims to reinforce the commercial rollout of the company’s BIO-SEA ballast water treatment system across Asia.

BIO-UV Group will draw on HCT’s extensive network of Chinese shipyards with a view to accelerate the take-up the of the BIO-SEA systems across the region, strengthening the French company’s presence in Asia.

Benoit Gillmann, CEO and founder of BIO-UV Group, said: “We are delighted to have entered into this highly strategic partnership with Hai Cheung. By teaming up with a benchmark supplier in China’s shipbuilding market, we get to benefit from its unique expertise and vast capacity in the region which will help us to rapidly roll out our business strategy and durably establish BIO-UV Group in a fast-growing market.”

HCT will support Chinese shipyards with the supply, installation and commissioning of the BIO-SEA system.

Randolph Zhang, President, Hai Cheung Trading, said: “We are delighted to have formed this relationship with BIO-UV Group. By combining the knowledge of our two organisations we will provide a robust and bespoke service to all our customers in the area.”

Xavier Deval, BIO-SEA Business Director, said: “This partnership comes at a time when the market is very favourable towards UV-based BWMS. The alliance we have formed with HCT aims to raise the competitiveness of our technology in the market.”

Deval furthered that BIO-SEA’s IMO and USCG certification is a significant attraction for Asia shipowners looking to comply with the requirements. “This, combined with BIO-UV’s high-performance systems and HCT’s enhanced knowledge of China’s maritime ecosystem, will ensure we are in pole position to quickly and effectively meet the Asian shipowners and shipyards’ requirements.”

In addition to added business leverage, BIO-UV Group will transfer the assembly and production BIO-SEA parts to HCT’s Nanjing site. “Production flexibility and responsiveness are key competitive advantages in a strong growth market,” said Deval.

“There is currently conflict in the BWMS market between price and system availability, but we have managed to remain competitive and we can provide systems within a six-week lead time. There are units available on the shelves that can be delivered in three weeks.”

Deval said new emissions legislation has had an impact on drydock availability given the number of slots booked for exhaust gas cleaning system installations.

“There is definitely a bottleneck,” he said. “Shipowners are struggling to find slots for BWMS installations and are now combining their scrubber projects with ballast water treatment system retrofits. Shipowners can no longer afford to run down the ballast water compliance clock.”